Luxembourg, often heralded for its robust financial sector, is undergoing a profound transformation powered by technology. In this article, we explore the digital revolution taking place in Luxembourg’s banking industry, shedding light on the innovative technologies reshaping the financial landscape of the Grand Duchy.

The Digital Imperative:

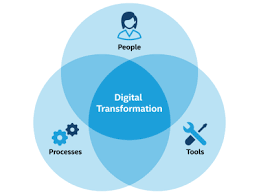

The global shift towards digitalization has not spared the banking sector, and Luxembourg, with its forward-thinking financial institutions, is embracing this transformation. Digitalization is not just a modernization effort but a strategic imperative to enhance efficiency, improve customer experiences, and stay competitive in an ever-evolving financial ecosystem.

Fintech Prowess in Luxembourg:

Luxembourg’s commitment to becoming a leading fintech hub is evident in the flourishing ecosystem of financial technology companies. These fintech innovators are disrupting traditional banking models by introducing novel solutions in areas like digital payments, blockchain, robo-advisory, and RegTech. The Grand Duchy’s regulatory environment, known for its adaptability, fosters an ideal playground for fintech experimentation.

Blockchain and Cryptocurrencies:

Luxembourg stands at the forefront of blockchain adoption in banking. The technology, known for its transparency and security features, is being leveraged to streamline processes such as cross-border payments, trade finance, and digital identity verification. Cryptocurrencies, too, are gaining traction, with Luxembourg-based financial institutions exploring their integration into traditional banking services.

Open Banking Initiatives:

Luxembourg’s banking sector is championing the principles of open banking. Financial institutions are increasingly embracing APIs (Application Programming Interfaces) to facilitate secure data sharing and interoperability between different banking and financial service providers. This openness not only enhances collaboration but also paves the way for a more interconnected and customer-centric banking experience.

AI and Data Analytics:

Artificial Intelligence (AI) and advanced data analytics are becoming integral components of Luxembourg’s banking operations. From personalized customer experiences and credit scoring to fraud detection and risk management, AI is enhancing decision-making processes. The use of big data analytics is providing banks with valuable insights, helping them tailor their services to meet the evolving needs of their clientele.

Digital Customer Experiences:

Luxembourg’s banks are redefining customer experiences through digital channels. Mobile banking apps, online account management, and chatbot-driven customer support are becoming standard offerings. The emphasis is not only on providing convenience but also on creating personalized and user-friendly interfaces that resonate with the expectations of today’s tech-savvy consumers.

Cybersecurity in Focus:

With the increasing reliance on digital technologies, cybersecurity has become a top priority for Luxembourg’s banks. Robust cybersecurity measures are being implemented to safeguard customer data, financial transactions, and the overall integrity of the banking infrastructure. The Grand Duchy is proactive in addressing cybersecurity challenges to ensure a resilient and secure digital banking environment.

Challenges and Opportunities:

While the digital transformation brings immense opportunities, it also presents challenges. Ensuring regulatory compliance, addressing cybersecurity risks, and navigating the complexities of integrating legacy systems with new technologies are areas that demand strategic focus. However, these challenges, when tackled effectively, open doors to a more agile, efficient, and innovative banking sector.

Conclusion:

Luxembourg’s banking sector is at the vanguard of the digital revolution, embracing technology to reimagine traditional banking practices. As the Grand Duchy continues its journey towards a tech-driven financial future, the synergy between innovation, regulation, and customer-centricity positions Luxembourg as a trailblazer in the global landscape of digital banking transformation. The ongoing evolution promises not only a more efficient and secure banking experience for individuals and businesses but also establishes Luxembourg as a key player in shaping the future of finance.

Senior Business Analyst with a track record of spearheading international operations between Europe, America, UAE, and Asia. Specializing in risk management and financial modeling in the financial services sector. Fluent in English, Italian (native), with basic knowledge of German and French. Seeking a role to apply strategic insights and leadership skills.