#Can someone stop the evolution of the non performing loans?

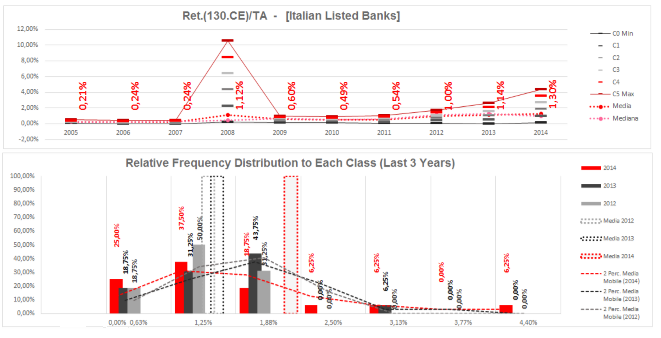

The Italina Listed Banks are having troubles to get results, it seems that the major problem is due to the increasing of Non Performing Loans and Distressed Assets. (As it showed on the (NPL+DA)/Total Assets in the figure). The relative effect has un impact on the tier1 and Core Tier 1, so shareholders are called to reinforce the bank’s equity by reducing the capital destined to new investments to stay competitive.

So, can someone stop the evolution of the non performing loans? Or we will wait the 2020 to see the revival of the sector?

FP&A Analyst. Lettore affamato. Blogger sfrenato. Investitore. Advisor. Hiker. Appassionato di impresa, di investimenti, di strategie di crescita, di turnaround, di storia e di scacchi. Esperto in analisi finanziarie e strategie di impresa, con Master in Controllo di Gestione, Laurea in Economia e Finanza, tra numeri e libri, tra una tazza di caffè e l’altra, leggo, scrivo e mi diverto, aiutando gli altri a realizzare le buone idee.